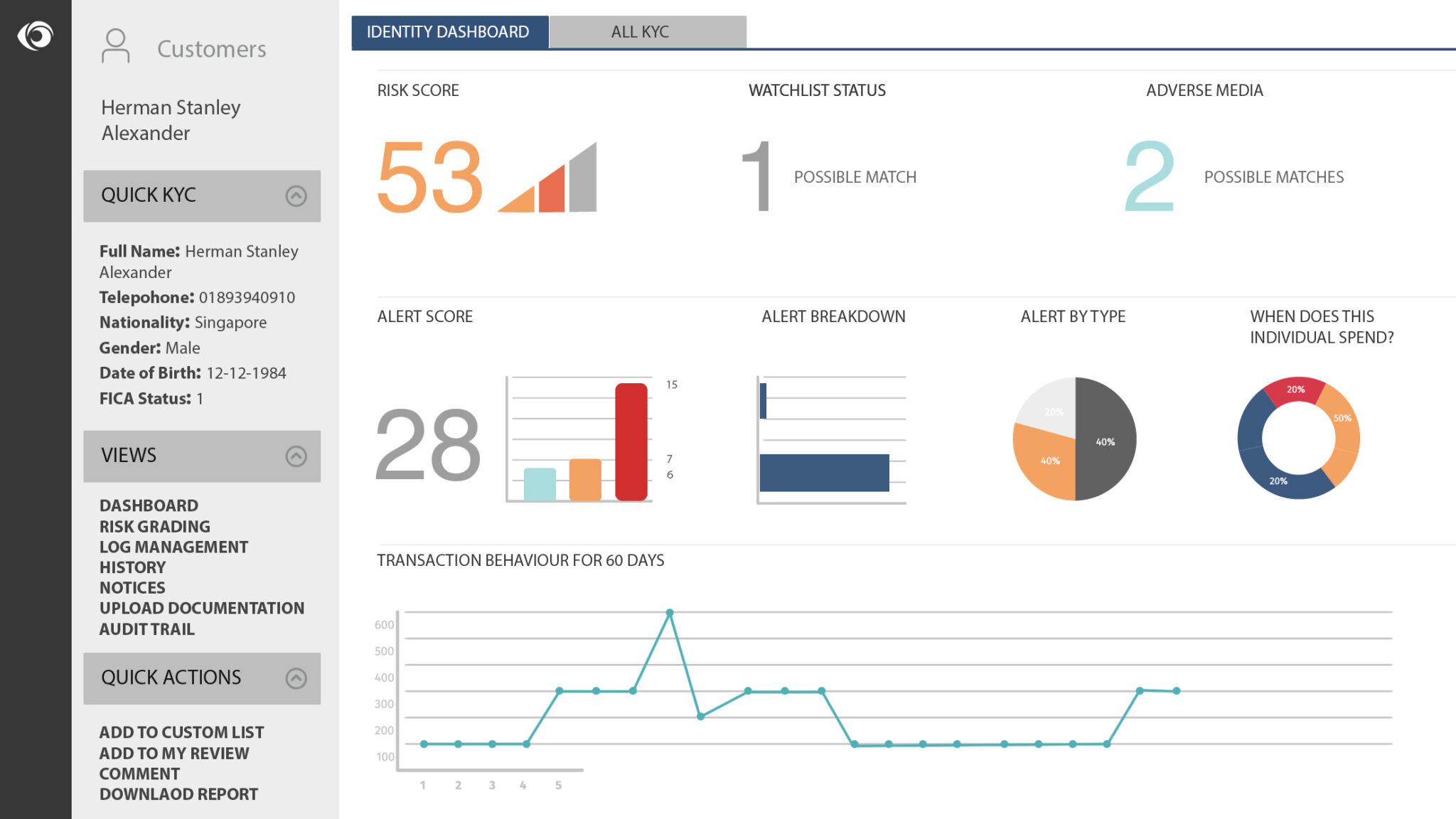

RISKSECURE Monitor

Manage all your AML, Fraud, Watchlist, and Adverse Media monitoring in ONE powerful, central solution.

Leading companies rely on RISKSECURE

RISKSECURE Version 7.0

Preparing you for every new generation of financial crime and fraud

Workflow and Case Manager

Optimize your investigation workflows and record findings at every step of the way using RISKSECURE's automated case management toolkit.

Adverse Media and Enhanced Due Diligence

Harness the power of news and social data to identify more information on an individual or entity that requires further investigations or additional information automatically with auto report creation and adverse risk score allocation within a matter of minutes.

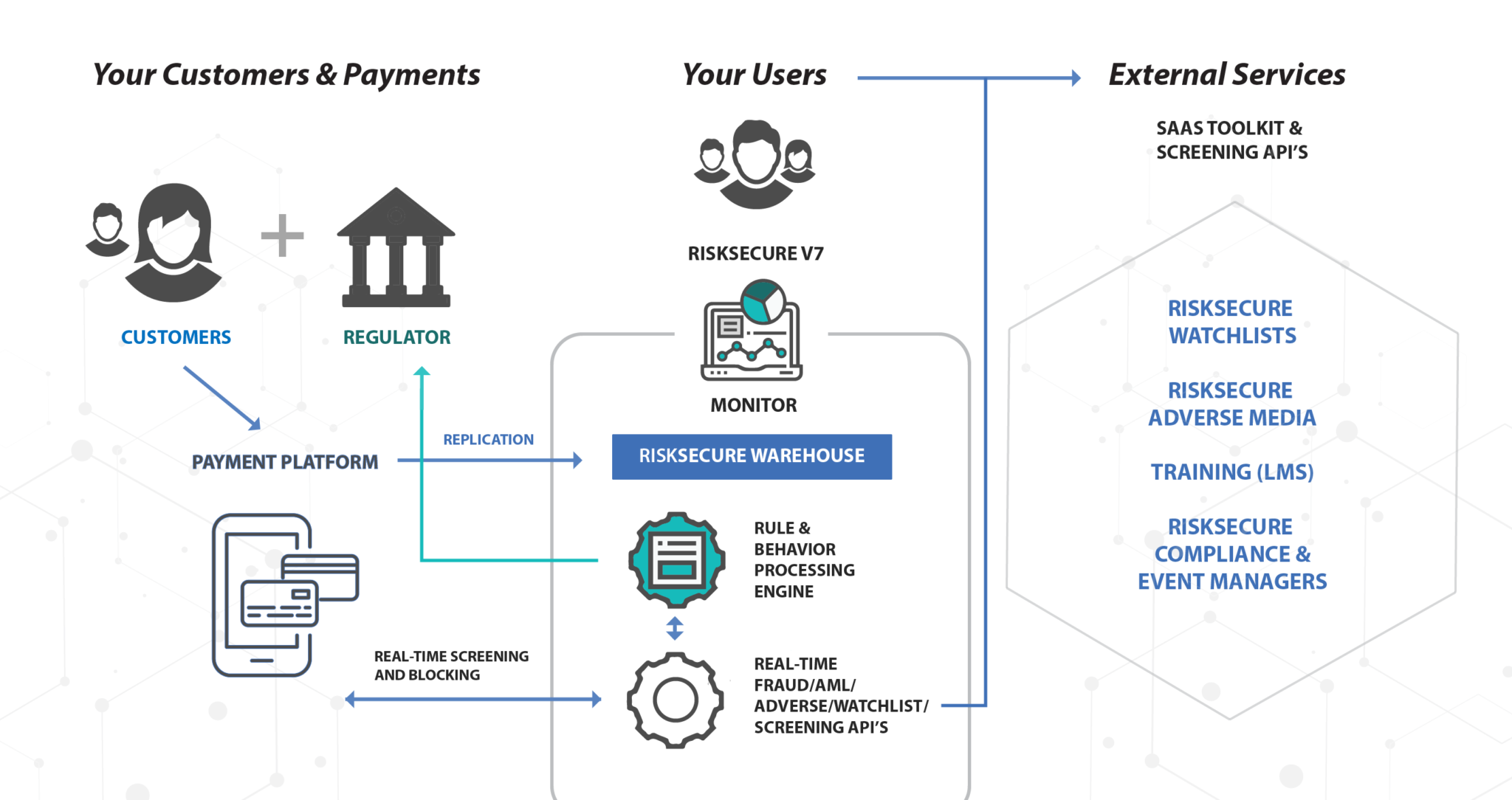

Real-time screening and alerting

Integrate with our API and rapidly screen thousands of transactions per second and detect sanctioned, politically connected entities or Adverse Media via our API’s.

Multi-Level Wanted Name Search

Search multiple online global lists with one search of individual and organization who require further investigation or due diligence.

Risk Based Scoring

An online calculated score that dynamically changes, as your data changes to best reflect the risk profile of a customer or third party.

Auto-Investigator

Automated investigator utilizing HLBNGA's latest technology.

RISKSECURE's scalable, fully risk-based architecture is aligned to the latest screening and monitoring regulations and standards

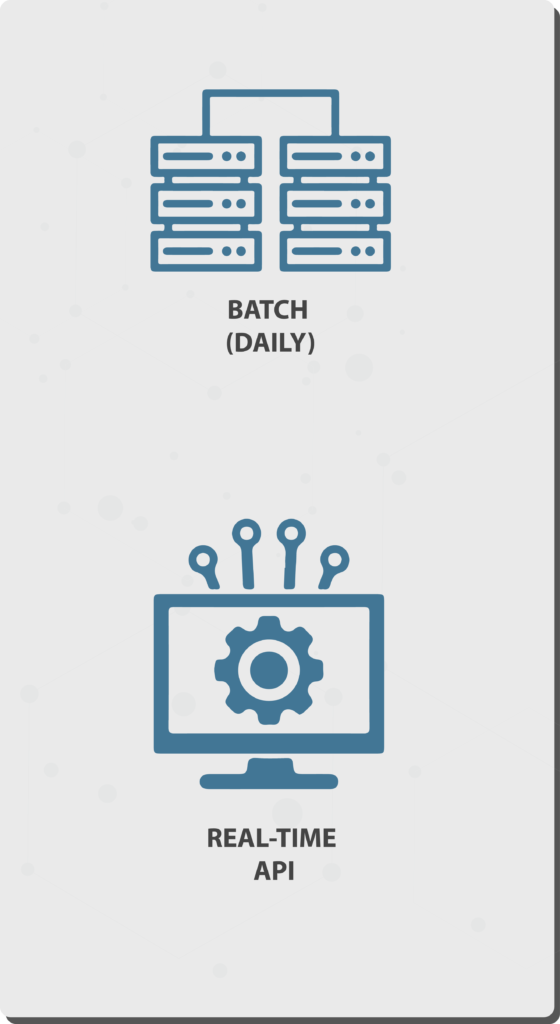

A range of deployment and integration options to meet your budget and preferences

Hosted Cloud-based SaaS Web Solution

On-premises

API integration tools (on-prem or hosted)

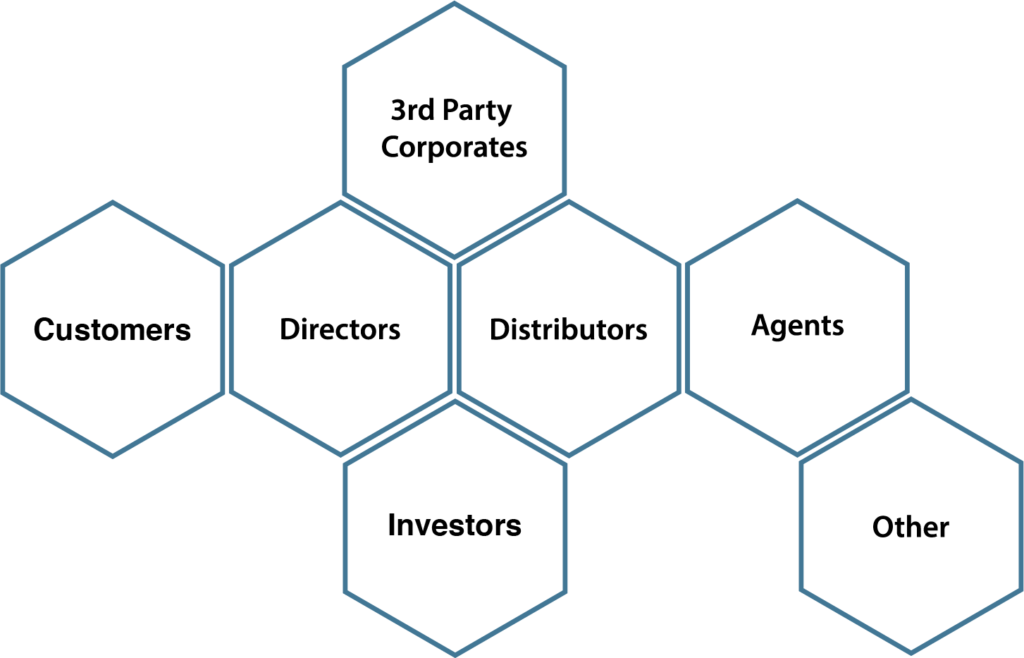

Ensure all your business relationships comply with applicable laws and regulations and have the same level of ethical conduct as your organization.

Most Major Watchlist providers supported

Multidimensional screening modules available for these world-class data sets (Data licenses to be procured separately).

HLBNGA Watchlists

We offer a cost-effective consolidated watchlist dataset that can be used by businesses of all sizes.

Click here for more information

Dow Jones

Lexis Nexis

Refinitiv

Compliance reporting engine

Automate your reporting forms to collect the data required to integrate and automatically forward on to regulatory authorities.

AML reporting Modules available:

- IFTR

- FATCA/CRS

- CTR/A (goAML web module)

- Automated Section 27 Reporting (web module)

- BASEL

- STR/SAR (web module)

Other reporting modules available:

- HLAMDA

- NCA returns

Your requirement is not listed? Contact us, we might be able to assist.

Ready to join our customers and make the move from reactive to proactive?

World-class Professional Services

From pre-sales to post-implementation, with over 150 years of combined AML deployment experience under their belt. Our team of highly skilled experts and consultants aim to exceed expectations and help you every step of the way. Let us design and build your solution.

- Consulting

- Subject matter experts

- Project management

- Integration services

- Data Engineers

- Training

- Quality assurance

- Report Development

- Post go-live support (against SLA)

Further Reading

RISKSECURE

RESTFUL API’s

Integrate checks into your onboarding workflows and screen persons and corporates in real-time.

RISKSECURE

Watchlist Screening

Screen your customers and 3rd parties against watchlists such as OFAC, UN, HMT, EU, PEP and other lists from around the world.

RISKSECURE

data

Enhance your compliance screening workflow with richer Adverse Media and Watchlist insights.