KYC Evolution: Cutting Costs, Saving Time

by Kyle Stroombergen – General Manager of HLBNGA

In today’s world of corporate compliance, the challenges of overspending on Know Your Customer (KYC) solutions and slow processes are prominent. These issues go beyond finances, impacting client relationships and operational efficiency.

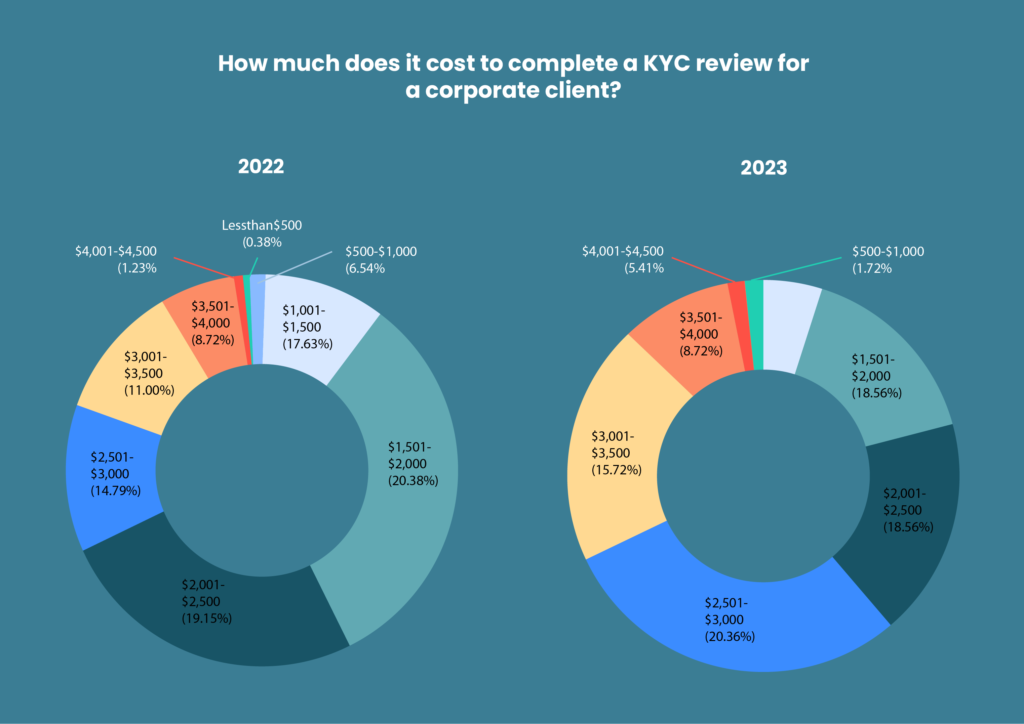

Fenergo’s 2022 KYC Trends report, surveying over 1,000 C-suite executives globally, reveals increasing costs and time commitments in corporate banking KYC procedures, signifying financial and operational strains.

The average cost for a single KYC review is now about $2,598 USD (around ZAR 38,970), up 17% from the previous year, and the completion time has risen to 95 days, compared to 84 days previously.

These growing expenses and extended durations are pressing concerns, compounded by factors like talent shortages and escalating compliance complexities.

The ramifications of sluggish KYC processes extend beyond financial implications, posing increased risks of financial crime and regulatory penalties while dampening customer satisfaction and retention in a competitive market.

Key areas contributing to excessive spending include:

1. Manual Processes: Manual KYC tasks in many financial institutions are labour-intensive and time-consuming, leading to slower and more expensive processes.

2. Redundant Screening: Companies often undergo costly, repetitive screening processes during KYC. Streamlining these processes is essential for cost reduction and faster onboarding.

3. Regulatory Changes and Compliance: Frequent changes in financial crime and compliance regulations increase the complexity and cost of KYC, requiring continuous updates in procedures.

4. Review Backlogs and Talent Shortages: Banks struggle with backlogs in KYC reviews and face industry-wide talent shortages, hindering efficient completion of KYC processes.

5. Poor Data Management: Inefficient handling of data in KYC processes leads to increased costs, highlighting the need for effective data management solutions.

6. Lack of Automation and Digital Transformation: Despite a trend towards automation, many KYC tasks remain manual, resulting in slower and more expensive processes due to a lack of digital transformation.

Latest innovations in KYC screening

Fenergo’s report highlights the urgent need for banks to enhance their KYC processes with more efficient, cost-effective methods.

Integrating comprehensive unified screening solutions like RiskSecure can streamline KYC procedures. Such technological advancements are essential in reducing costs and timeframes, improving efficiency, and ensuring compliance in today’s fast-paced financial sector.

To address the high costs associated with traditional KYC methods, companies are increasingly leveraging data, AI, and technology to streamline processes and reduce expenditures.

Here’s an overview of the latest screening methods being adopted:

1. Screening Automation: Automation reduces manual labor and errors, quickly processing large data volumes and cutting time and costs in KYC processes.

2. Smart Real-Time PEP/Sanctions Screening: Advanced real-time technology enhances screening against sanctions, PEPs, and watchlists, managing false positives for better accuracy and reduced workload.

3. Non-Official PEPs and Media Connections Screening: New solutions detect unofficial PEPs and political ties in media using NLP and machine learning, mitigating hidden risks.

4. Advanced Adverse Media Scoring: Methods like the COMFORT™ score are part of a trend towards more refined adverse media screening using AI for accurate risk assessments.

5. Integrated Company Checks: Real-time integration with databases like CIPC aids in verifying company status and ownership, crucial for identifying shell companies and corporate structures.

6. Internal ‘Do Not Do Business’ Lists: Firms are creating internal databases to flag risky entities, proactively avoiding potential threats during KYC.

7. Association Risk Screening: Evaluating risks from a client’s associates through advanced analytics uncovers hidden dangers within their network.

8. Country Risk Assessment: AI tools assess risks related to a client’s operational country, analyzing political, corruption, and economic factors.

9. Data Breach Risk Screening: Identifying entities with past data breaches is vital for assessing their security and reliability as potential clients.

Importance of an Integrated Solution:

Having all these features in a single solution offers several benefits:

· Efficiency: Streamlines the KYC process, reducing the time and effort required for compliance.

· Consistency: Ensures uniform risk assessments and compliance standards across the board.

· Cost-Effectiveness: Reduces the need for multiple tools and platforms, thereby lowering operational costs.

· Real-Time Updates: Integrated solutions can offer real-time updates and alerts, which are essential for maintaining ongoing compliance.

These methods represent a significant shift from traditional KYC processes, leveraging the power of AI, machine learning, and big data analytics to enhance accuracy, reduce costs, and streamline compliance efforts. The focus is on creating a more dynamic, real-time approach to KYC, which adapts to the continuously evolving regulatory landscape and the complexities of global business operations.

RiskSecure streamlines KYC and KYB screening workflows by integrating advanced onboarding and ongoing monitoring solutions, offering efficient, comprehensive compliance through automated checks and real-time analysis